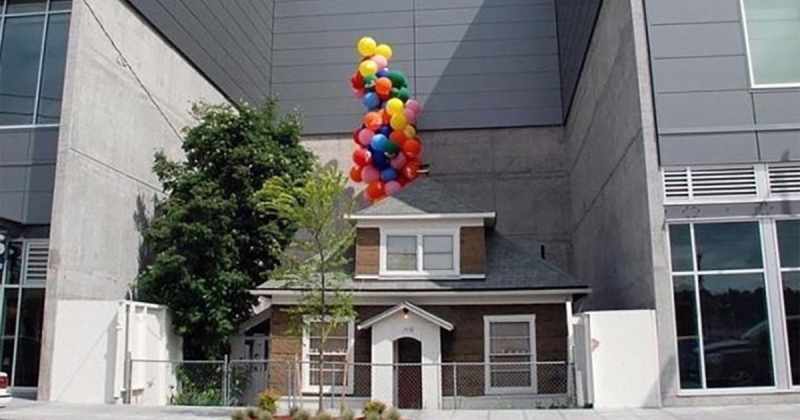

Property disputes can come in many forms: from squabbles between neighbors about boundary lines to legal battles in a divorce proceeding over shared assets. In these situations, a property appraisal can be an indispensable tool in the lawyer’s arsenal. By providing an objective assessment of the property’s market value, an appraisal can aid in dispute resolution, assist in legal arguments, and guide negotiations. This guide aims to provide a comprehensive understanding of the role of appraisals in property disputes, and how they can be leveraged for optimal outcomes.

Defining Appraisals

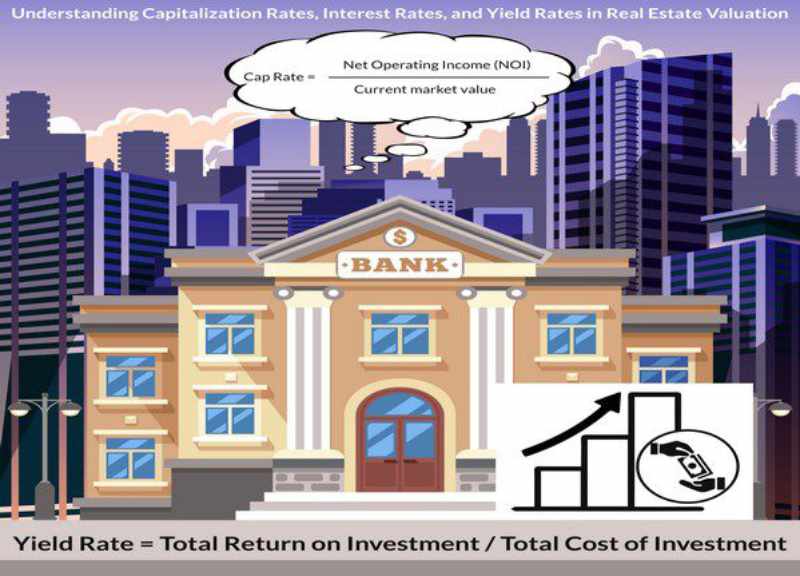

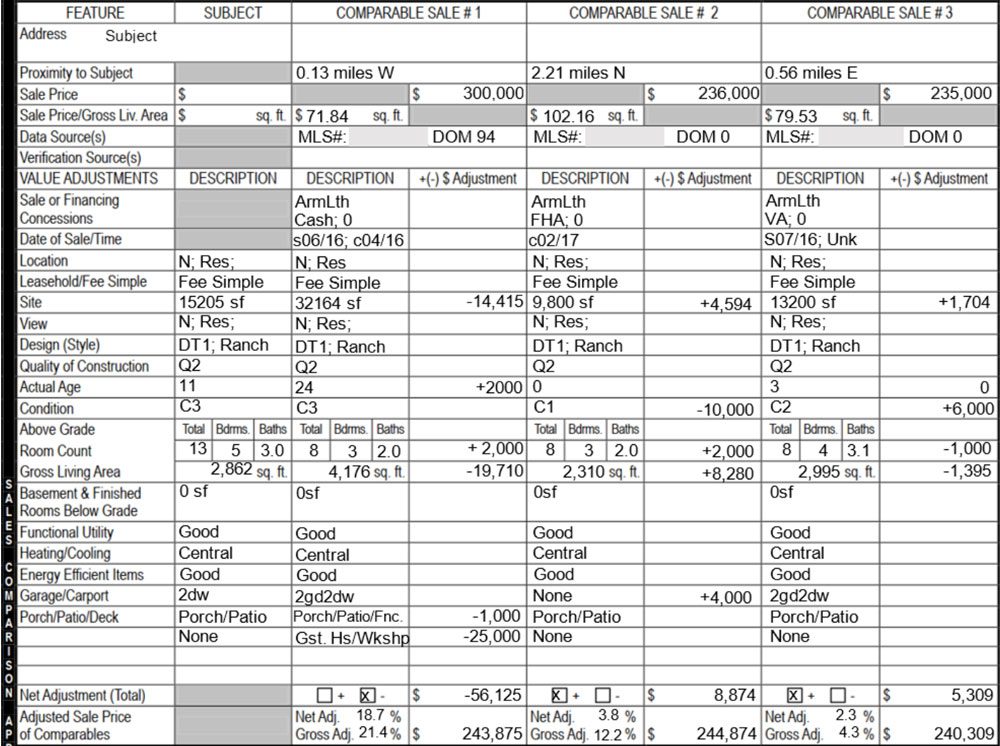

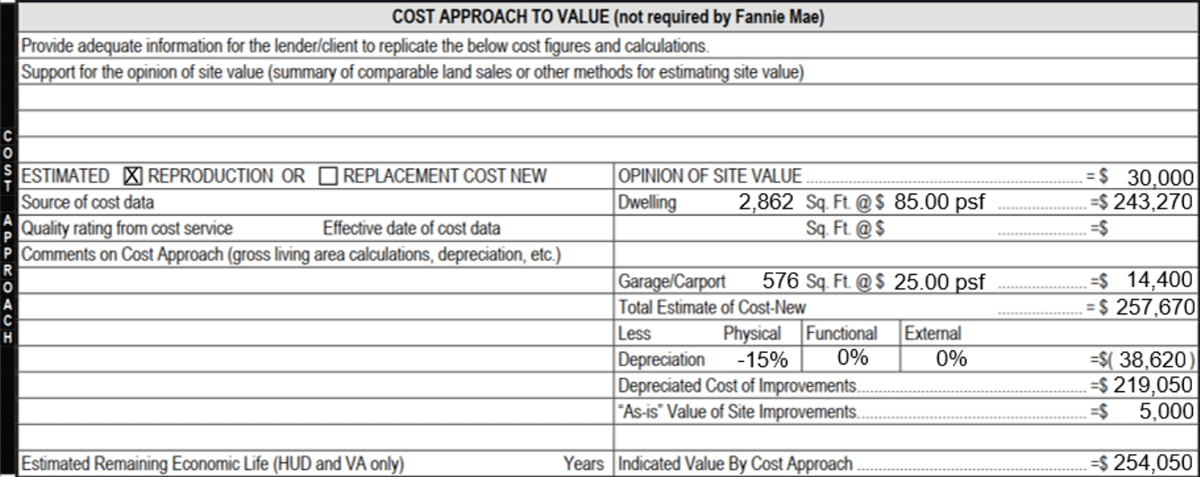

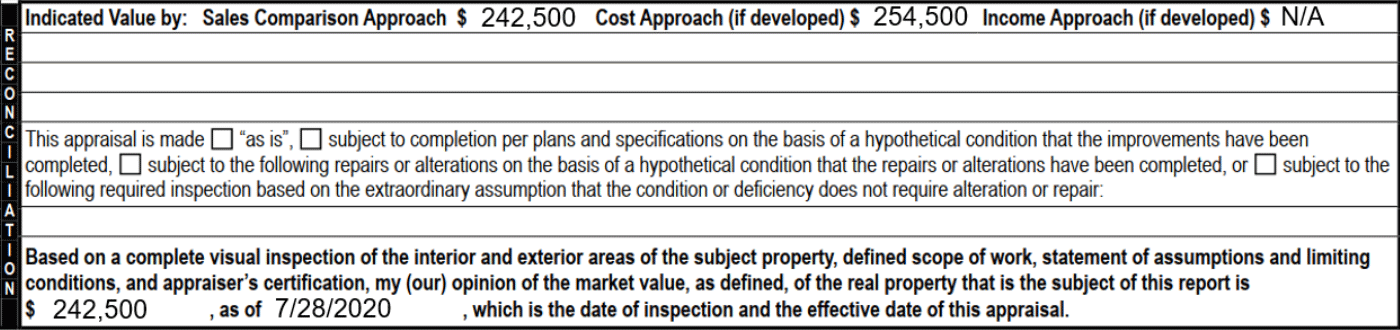

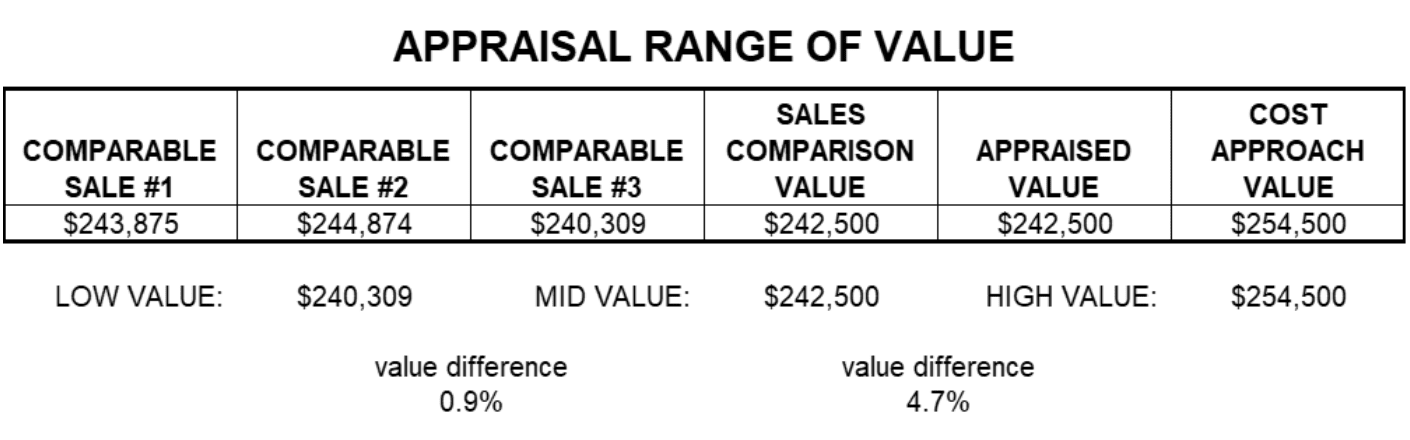

An appraisal is an unbiased, professional assessment of the value of a property, conducted by a certified property appraiser. This process involves examining a range of factors, including the property’s location, its condition and features, any improvements made, and the value of comparable properties in the local market. The final appraisal report gives an estimated market value of the property, providing a financial baseline for negotiations, settlements, and legal arguments.

The Crucial Role of Appraisals in Property Disputes

The critical role of appraisals in property disputes is multi-faceted, with several key functions that can significantly influence the outcome of a dispute:

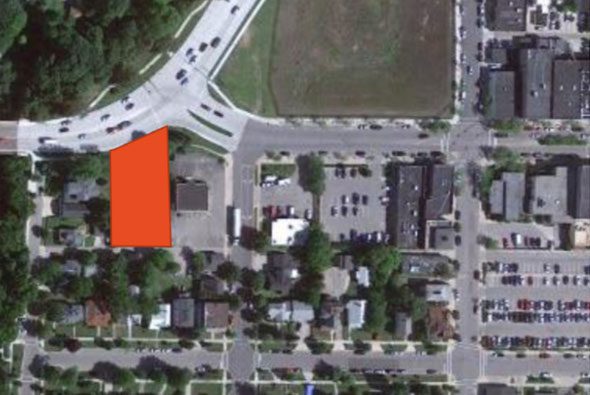

Establishing Fair Market Value: Perhaps the most important role of an appraisal is that it establishes the property’s fair market value. Given that property disputes often revolve around differing perceptions of value, an appraisal can help settle these disputes by offering a value that is unbiased and free from personal interest.

Supporting Legal Arguments: An accurate, well-conducted appraisal can also serve as a substantial piece of evidence in a court of law. If you are arguing that a property has been undervalued or overvalued, for instance, an appraisal can provide the evidence necessary to support your claim.

Facilitating Settlements: Having a credible appraisal in hand can be instrumental in promoting settlements. When parties have a clear understanding of the property’s value, they are often more likely to reach an agreement and avoid a prolonged court battle.

Maximizing the Benefits of Appraisals

Understanding the role of appraisals in property disputes is only the first step. For lawyers, effectively utilizing appraisals is a skill that can significantly enhance their ability to represent their clients:

Select a Qualified Appraiser: The first step in ensuring a reliable appraisal is hiring a qualified, certified appraiser. The appraiser’s expertise, reputation, and credibility can greatly impact the perceived reliability of the appraisal.

Understand the Appraisal Process: Having a thorough understanding of how appraisals are conducted can help you scrutinize the appraisal report effectively. It can also aid you in cross-examining the opposing appraiser, if required, and identifying any potential flaws or biases in their assessment.

Obtain Multiple Appraisals: In some cases, obtaining multiple appraisals can be beneficial. If the values determined by different appraisers differ significantly, it can open up room for negotiation and provide further evidence to support your case in court.

Utilize Appraisals in Negotiation: The value determined by an appraisal can serve as a solid foundation for negotiations. It provides an objective, monetary figure around which discussions can revolve, potentially making the negotiation process smoother and more productive.

Appraisal Challenges

While appraisals are a valuable tool, it’s also essential to be aware of potential challenges:

Subjectivity: Despite efforts to maintain objectivity, an appraisal can sometimes be influenced by the appraiser’s judgment. As such, it’s important to critically examine the appraisal for potential bias.

Market Fluctuations: Property values can fluctuate due to market conditions. An appraisal is a snapshot of a property’s value at a given time, and may not represent the value at a later date.

Discrepancies in Appraisals: Sometimes, different appraisers may come up with different values for the same property. In such cases, the reasons for the discrepancy should be explored and addressed.

Appraisals play an indispensable role in property disputes, providing an objective valuation that can guide decision-making, bolster legal arguments, and encourage dispute resolution. By understanding the appraisal process and effectively utilizing the results, lawyers can dramatically improve their ability to represent their clients in property disputes. However, it’s also essential to critically examine appraisals, understanding that they are a tool – highly effective, but not infallible. By doing so, you can use appraisals to their fullest potential, driving toward a fair and efficient resolution of the dispute at hand.