Mixed-use developments, which integrate residential, commercial, and sometimes industrial components within a single project, represent a modern approach to urban planning. However, appraising such complex properties presents unique challenges and opportunities for real estate professionals. This article explores the intricate landscape of mixed-use development appraisal, providing insights into the difficulties faced and the potential benefits realized through this multidimensional process.

Challenges in Appraising Mixed-Use Developments

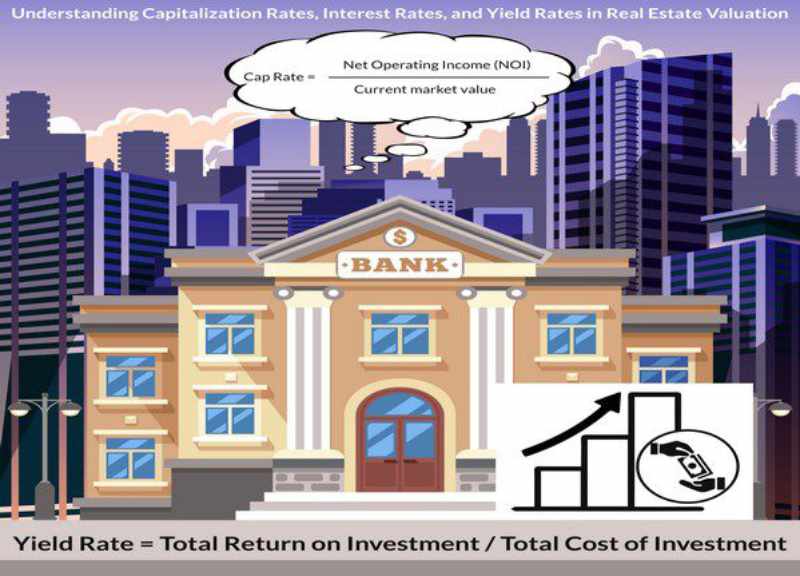

- Complex Valuation Models: Mixed-use properties require appraisers to be adept in multiple valuation methods. Since these developments encompass various property types (e.g., retail, office, residential), an appraiser must combine elements of each type’s valuation techniques. This complexity increases the risk of error and requires a higher level of expertise and experience.

- Integrating Different Valuation Techniques: Each component of a mixed-use development typically requires a different valuation approach. Combining these different approaches within a single appraisal framework demands a highly nuanced understanding of each market segment.

- Customized Financial Models: Developing financial models that accurately capture the interplay between different uses within a mixed-use development is crucial. These models must account for shared amenities, management efficiencies, and other synergistic benefits that can affect value.

- Diverse Income Streams: Mixed-use developments generate income from varied sources. Residential units might offer steady rental income, while commercial spaces could provide variable income based on business performance. This diversity complicates cash flow analysis and forecasting, demanding a thorough understanding of different market dynamics.

- Risk Assessment: Different income streams carry varying levels of risk. For instance, commercial rents are generally more susceptible to economic fluctuations than residential rents. Appraisers must factor these risks into their valuation to provide a realistic picture of potential income variability.

- Lease Analysis: Analyzing lease agreements across different types of tenants and leases (e.g., retail, office, residential, long term vs short term) is essential for understanding terms, conditions, and the impact of these leases on the overall value of the property.

- Zoning and Regulatory Issues: Zoning laws can vary significantly across regions and can affect the permissible uses within mixed-use developments. Navigating these regulations requires a deep understanding of local laws to accurately assess potential legal challenges or restrictions impacting the property’s appraisal.

- Compliance and Potential Changes: Keeping abreast of potential changes in zoning laws or other regulations that could affect future property uses is crucial. For instance, a change allowing more commercial development in an area can significantly affect a property’s appraisal.

- Impact on Development Plans: Regulatory constraints can also impact the design and scale of mixed-use developments. Appraisers need to consider how these factors influence not just current but also future property values and trends.

- Market Demand Fluctuations: The success of mixed-use developments heavily relies on the local market demand for both residential and commercial spaces. Shifts in the economy, such as a downturn in the retail sector, can adversely affect the entire property’s profitability and, consequently, its valuation.

- Demographic and Market Trends: Understanding local market trends and demographic shifts can help appraisers predict future demand for mixed-use properties. For example, an increase in remote working could boost demand for residential units.

- Economic Indicators: Tracking economic indicators relevant to all sectors present in the mixed-use development (such as retail sales growth or changes in office space demand) is essential for accurate appraisals.

- Physical and Functional Integration: Assessing the degree of integration between different uses within a single development is challenging. The synergy—or lack thereof—between the residential and commercial components can significantly influence the property’s appeal and functionality.

- Design and Layout Evaluation: The physical design and layout of mixed-use developments play a crucial role in their functionality and appeal. For instance, well-integrated parking solutions and pedestrian-friendly designs can significantly enhance the utility of such developments.

- Synergy Among Components: The success of mixed-use developments often hinges on the synergy between their different components. Appraisers need to evaluate how well these components complement each other to support a mixed-use environment.

Specific Advantages Appraisers Provide for Mixed-Use Developments:

- Innovative Market Niches: Mixed-use developments often create unique market niches that traditional single-use developments cannot offer. Appraisers with expertise in these properties are specialists and attract clients who are looking for professionals who understand the complex dynamics of mixed-use environments.

- Specialization Benefits: These properties are often less understood and more complex than single-use buildings. Appraisers who have a specialization in mixed-use properties can provide clients with the expertise they need.

- Consulting Opportunities: Appraisers with deep knowledge of mixed-use developments can also offer consulting services to developers during the planning stages, providing insights on the most beneficial mix of uses based on market demands.

- Enhanced Community Value: Properly appraised mixed-use developments can contribute to urban revitalization and sustainable community development. By accurately valuing these properties, appraisers play a crucial role in encouraging investments that lead to more integrated communities.

- Socioeconomic Contributions: By providing accurate appraisals, appraisers help facilitate investments that can lead to improved local economies and more cohesive communities.

- Environmental Impact: Accurate valuations help promote developments that optimize land use and potentially reduce urban sprawl, contributing to environmental sustainability.

- Professional Development: The complexities involved in mixed-use appraisals requires significant professional growth as appraisers need to have knowledge and skills across various real estate sectors.This can only be achieved through continuous learning and adaptation.

- Broader Service Offerings: With the expertise needed in such a challenging area of real estate valuations, appraisers offer a wider range of services to their clients, including advisory services on development and investment opportunities.

- Long-Term Relationships: Mixed-use developments often require ongoing appraisal services to monitor changes in value and market conditions.

Conclusion

Appraising mixed-use developments is not without its challenges. By understanding and navigating the multifaceted aspects of these properties, appraisers with the requisite expertise contribute to community development, and help clients run and expand their businesses. As cities continue to embrace mixed-use projects, the demand for skilled appraisers in this field will likely grow, underscoring the importance of engaging appraisers who have mastered the complexities of mixed-use real estate appraisal.